THE POWER PLAYERS How Nexstar and Sinclair Control America’s Airwaves SPECIAL REPORT: The Media Giants That Can Make or Break Network Television

INSIDE THIS ISSUE:

- The Gatekeepers: Meet the two broadcast giants that control what America watches

- Silent Power: How station groups can override network decisions

- The Kimmel Crisis: Inside the controversial suspension of a Disney/ABC talk show

- Media Monopolies: What consolidation means for the future of television

- The Regulatory Landscape: The FCC’s role in broadcast disputes

THE NEW MEDIA MONARCHS

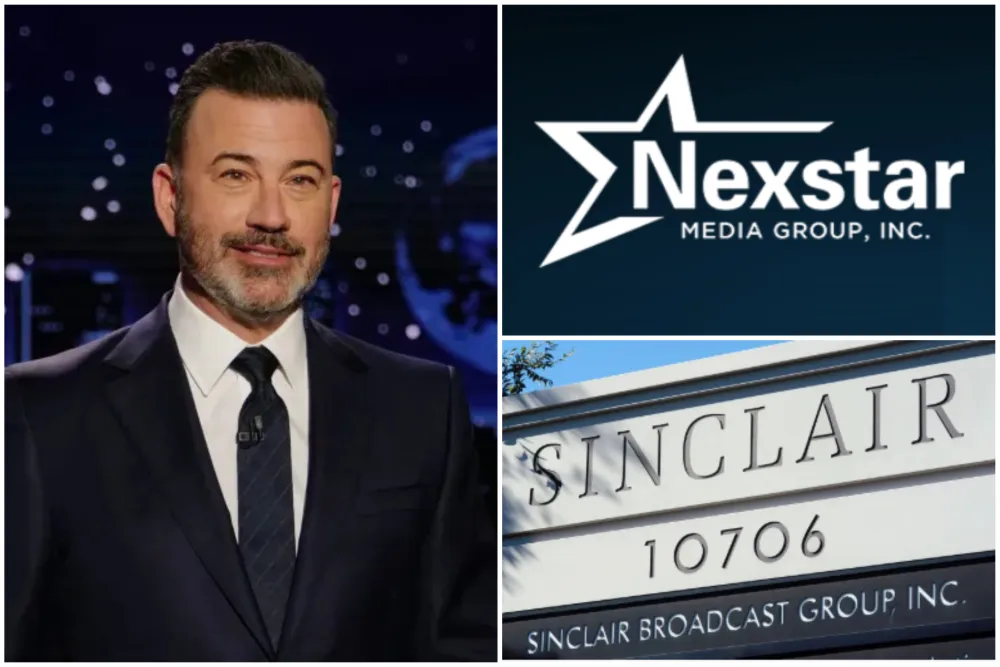

In America’s vast media landscape, most viewers rarely think about who actually owns the local TV stations that bring network programming into their homes. When you tune in to watch ABC’s Jimmy Kimmel or your local news, you’re likely watching a station owned not by the network itself, but by one of two dominant media conglomerates: Nexstar Media Group or Sinclair Broadcast Group.

These two broadcasting giants have quietly amassed extraordinary influence over America’s television ecosystem. Together, they control hundreds of local TV stations reaching the majority of US households, giving them unprecedented power to determine what content reaches American viewers.

The extent of this power became dramatically clear in September 2025, when Nexstar made the unilateral decision to pull ABC’s long-running “Jimmy Kimmel Live!” from its stations following controversial comments by the host about the assassination of conservative figure Charlie Kirk. Sinclair quickly followed suit, and within hours, Disney and ABC announced they would suspend the show indefinitely.

This newsletter examines how two companies most Americans have never heard of came to wield such extraordinary influence over our media landscape, and what their growing power means for the future of broadcasting, free speech, and the information Americans receive.

THE RISE OF NEXSTAR: AMERICA’S BROADCAST BEHEMOTH

Humble Beginnings to Media Giant

Nexstar’s story begins in 1996 with a single television station purchase in Scranton, Pennsylvania. Founded by industry pioneer Perry A. Sook, who remains Chairman and CEO to this day, Nexstar has transformed from a modest regional broadcaster into the undisputed colossus of local television.

“With the purchase of Scranton, PA station WYOU in 1996, broadcast industry pioneer and Nexstar Chairman and CEO, Perry A. Sook, founded Nexstar and began building the foundation of what more than two decades later has become the largest local broadcast television and media company in the United States,” reads the company’s official history.

The company’s growth strategy has been methodical and aggressive. After going public in 2003, Nexstar doubled down on acquisitions, gradually expanding its footprint across America. But the true watershed moments came with two massive acquisitions: Media General in 2016 and Tribune Media in 2019.

The Tribune acquisition, valued at $6.4 billion, catapulted Nexstar to unprecedented dominance. Today, Nexstar operates more than 200 television stations across 116 markets, reaching an estimated 212 million Americans—approximately 68% of all US television households. This makes Nexstar not just the largest owner of local TV stations in America, but one of the most influential media companies in the country.

Beyond Broadcast: Nexstar’s Expanding Empire

While local television remains Nexstar’s foundation, the company has strategically diversified its portfolio. It owns cable network NewsNation (formerly WGN America), digital news operations, and has invested heavily in next-generation broadcast technologies.

Nexstar has also been at the forefront of reshaping the economics of broadcasting. In 2005, under Sook’s leadership, Nexstar took the then-controversial stance of demanding payment from cable and satellite providers for retransmitting its local stations—a practice now standard across the industry that generates billions in revenue.

The company’s trajectory reveals a consistent pattern: strategic acquisitions, operational efficiency, and leveraging scale to maximize influence and profitability. This approach has made Nexstar a Wall Street darling, with its stock value increasing dramatically over the past decade.

But this growth has come with heightened scrutiny. Media watchdogs and regulatory bodies have raised concerns about the implications of such concentrated ownership. When a single company controls the local news and programming in dozens of American cities, questions inevitably arise about diversity of viewpoints, localism, and the public interest.

The Numbers Behind the Power

To truly understand Nexstar’s influence, consider these statistics:

- 200+ television stations owned or operated

- Presence in 116 markets across America

- Reaches 68% of US television households

- Owns stations affiliated with all major networks (ABC, CBS, NBC, Fox)

- Controls the largest collection of local websites in the US

- Annual revenue exceeding $4.5 billion

This reach gives Nexstar extraordinary leverage when negotiating with networks like Disney/ABC, CBS, NBC, and Fox. While these networks create the content, they rely on local affiliates to distribute it to viewers across America. Nexstar, as the largest owner of these affiliates, has significant influence over what programming reaches American homes.

In early 2025, Nexstar announced its intent to acquire another major broadcaster, TEGNA, in a deal valued at $6.2 billion. This pending acquisition, if approved by regulators, would further cement Nexstar’s position as America’s dominant local television company and potentially increase its negotiating power with major networks.

SINCLAIR: THE CONSERVATIVE BROADCASTING POWERHOUSE

From Family Business to Broadcasting Force

While Nexstar may claim the title of America’s largest broadcaster by station count, Sinclair Broadcast Group represents another form of media power—one that combines extensive reach with a distinctive editorial perspective.

Founded by Julian Sinclair Smith with a single Baltimore television station in 1971, Sinclair has grown into the second-largest television station operator in the United States. Now controlled by the descendants of its founder, particularly David Smith, Sinclair owns or operates 193 stations across more than 100 markets, covering approximately 40% of American households.

What distinguishes Sinclair from competitors like Nexstar is not just its size but its well-documented conservative editorial leanings. The company has frequently made headlines for requiring its local stations to air “must-run” segments featuring conservative commentary, prompting both praise from conservatives who see it as a counterbalance to perceived liberal media bias and criticism from those who question whether such centralized editorial control serves local communities.

Strategic Growth and Diversification

Like Nexstar, Sinclair has grown primarily through acquisitions, steadily expanding its portfolio of stations while developing new revenue streams. Beyond its broadcast properties, Sinclair owns several digital networks including Comet, Charge!, The Nest, and Roar, as well as the sports-oriented cable network Tennis Channel.

Sinclair’s growth strategy came to national attention in 2017 when it announced plans to acquire Tribune Media for $3.9 billion—a deal that would have created an unprecedented television giant with over 230 stations reaching 72% of American households. However, the deal collapsed in 2018 amid regulatory concerns and questions about Sinclair’s candor during the approval process.

Despite this setback, Sinclair has remained a formidable force in broadcasting, maintaining its position as the largest owner of stations affiliated with Fox, ABC, CBS, and NBC outside of the networks themselves. This gives Sinclair, like Nexstar, significant leverage in negotiations with these networks.

Network Relationships and Power Dynamics

The relationship between station groups like Sinclair and the major networks exemplifies the complex power dynamics of modern broadcasting. Networks provide the national programming and brand recognition, while station groups provide the local distribution infrastructure and community connections.

This symbiotic relationship works smoothly most of the time, but it can become contentious when station groups exercise their power to preempt or drop network programming—as happened with Jimmy Kimmel Live! in September 2025.

Sinclair’s conservative orientation adds another dimension to these dynamics. The company has occasionally found itself more aligned with Fox than with more centrist or progressive-leaning networks like ABC. These ideological considerations can influence programming decisions, including when and whether to preempt controversial content.

THE ANATOMY OF INFLUENCE: HOW STATION GROUPS EXERT CONTROL

The Affiliation Agreement: The Foundation of Power

To understand how companies like Nexstar and Sinclair can make decisions like dropping “Jimmy Kimmel Live!”, one must understand the fundamental structure of the television industry.

The relationship between networks and their affiliated stations is governed by affiliation agreements—contracts that specify the terms under which local stations will carry network programming. These agreements typically run for several years and include provisions regarding:

- Programming obligations: Which network shows the station must carry

- Preemption rights: When stations can replace network programming with local content

- Advertising inventory: How commercial time is divided between network and local station

- Compensation: Financial arrangements between networks and stations

Historically, networks paid affiliated stations to carry their programming. However, as the economics of television changed, this relationship flipped—stations now typically pay networks for popular content. This reversal, known as “reverse compensation,” has significantly altered the power dynamics in broadcasting.

Despite this shift, station groups like Nexstar and Sinclair retain considerable leverage, particularly when they control numerous affiliates of a single network. If a station group threatens to drop a network’s programming across dozens of markets simultaneously, the network faces potentially catastrophic audience and revenue losses.

Retransmission Consent: The Revenue Engine

Beyond their relationships with networks, station groups derive significant revenue and power from another source: retransmission consent fees paid by cable and satellite providers.

Under federal law, cable and satellite companies must obtain permission from broadcasters to retransmit their signals. This permission typically comes at a price—fees that have grown substantially over the past decade and now represent a critical revenue stream for companies like Nexstar and Sinclair.

These fees give station groups additional leverage, as they can threaten to withhold their signals from cable and satellite providers during negotiations, potentially causing these providers to lose subscribers. The threat of such “blackouts” has led to increasingly contentious negotiations and escalating fees.

The combination of network affiliation agreements and retransmission consent creates a complex web of relationships in which station groups like Nexstar and Sinclair occupy a crucial position—they are the gatekeepers controlling access to viewers for both content creators (networks) and content distributors (cable and satellite companies).

Local News: The Community Connection

Another source of station groups’ influence is their control over local news programming. Local news remains one of the most-watched and most-trusted forms of media in America, and companies like Nexstar and Sinclair own hundreds of local newsrooms nationwide.

This control of local news gives station groups significant influence over public perception and community trust. It also provides them with a platform to shape narratives around controversies, including disputes with networks over programming decisions.

When Nexstar decided to drop “Jimmy Kimmel Live!” in September 2025, its local stations could frame this decision through their news coverage, potentially influencing how viewers understood the controversy and perceived both Kimmel and Nexstar’s actions.

THE KIMMEL CONTROVERSY: A CASE STUDY IN MEDIA POWER

The Spark: Controversial Comments About a National Tragedy

The events leading to the suspension of “Jimmy Kimmel Live!” began on Monday, September 15, 2025, when Kimmel addressed the recent assassination of conservative activist Charlie Kirk during his opening monologue.

“We had some new lows over the weekend with the MAGA gang desperately trying to characterize this kid who murdered Charlie Kirk as anything other than one of them and with everything they can to score political points from it,” Kimmel said on his show.

The comments immediately sparked outrage among conservatives, who viewed them as insensitive and factually misleading at a time of national mourning. Critics argued that Kimmel was politicizing a tragedy and mischaracterizing the motives of the assassin.

The FCC Factor: Regulatory Pressure

The controversy escalated significantly when FCC Chairman Brendan Carr, a Trump appointee, publicly criticized Kimmel’s remarks during a podcast appearance with conservative commentator Benny Johnson.

Carr called Kimmel’s comments “some of the sickest conduct possible” and added, “Frankly, when you see stuff like this, I mean, we can do this the easy way, or these companies can find ways to change conduct, to take action, frankly, on Kimmel, or there’s going to be additional work for the FCC ahead.”

This statement from a federal regulator raised immediate concerns about government pressure on broadcasters. The FCC has significant regulatory authority over broadcast television, including the power to grant or deny license renewals for local stations.

Nexstar Makes Its Move

Later that same day, Nexstar announced that it would preempt “Jimmy Kimmel Live!” on all of its ABC-affiliated stations “for the foreseeable future.”

In a statement, Andrew Alford, president of Nexstar’s broadcasting division, said: “Mr. Kimmel’s comments about the death of Mr. Kirk are offensive and insensitive at a critical time in our national political discourse, and we do not believe they reflect the spectrum of opinions, views, or values of the local communities in which we are located. Continuing to give Mr. Kimmel a broadcast platform in the communities we serve is simply not in the public interest at the current time, and we have made the difficult decision to preempt his show in an effort to let cooler heads prevail as we move toward the resumption of respectful, constructive dialogue.”

Nexstar emphasized that this decision was made “unilaterally” by its senior executive team without communication with the FCC or any government agency.

Sinclair Follows, Disney Capitulates

Shortly after Nexstar’s announcement, Sinclair Broadcast Group informed Disney that it too would drop Kimmel’s show from its ABC affiliates. The company even went further, stating it would not lift the suspension until formal discussions were held with ABC regarding the network’s “commitment to professionalism and accountability.”

Faced with the prospect of its late-night flagship being unavailable in markets covering a significant portion of the U.S. population, Disney announced it was suspending “Jimmy Kimmel Live!” indefinitely.

This rapid sequence of events—from controversial comment to network suspension in less than 48 hours—demonstrated the extraordinary power that station groups like Nexstar and Sinclair wield over network programming decisions.

Business Considerations: The Merger Factor

Industry analysts have noted that Nexstar’s decision may have been influenced by more than just content concerns. The company is currently seeking FCC approval for its $6.2 billion acquisition of TEGNA, another major station group. Additionally, Nexstar has been advocating for the repeal of the FCC’s broadcast ownership rule, which limits any single company from owning stations that collectively reach more than 39% of U.S. households.

Similarly, Disney has significant regulatory matters before the FCC, including approval for a major NFL deal for ESPN. These pending business considerations may have influenced both companies’ decisions regarding Kimmel’s show.

As former President Barack Obama commented the day after the suspension: “This is precisely the kind of government coercion that the First Amendment was designed to prevent—and media companies need to start standing up rather than capitulating to it.”

THE BROADER LANDSCAPE: MEDIA CONSOLIDATION AND ITS CONSEQUENCES

The Accelerating Trend of Ownership Concentration

The power wielded by Nexstar and Sinclair in the Kimmel controversy is emblematic of a broader trend in American media: the increasing concentration of ownership in fewer hands.

Over the past three decades, regulatory changes and market forces have driven a dramatic consolidation of local television ownership. The Telecommunications Act of 1996 relaxed ownership limits, setting off a wave of mergers and acquisitions that continues to this day.

In 1983, 50 companies controlled 90% of American media. Today, that number has shrunk to just six major conglomerates, with Nexstar and Sinclair dominating local television specifically.

This consolidation has occurred across political administrations of both parties, reflecting a bipartisan willingness to allow media markets to concentrate despite the potential implications for diversity of viewpoints and local control.

The Economics of Scale: Why Consolidation Continues

The business case for media consolidation is compelling. Larger station groups benefit from economies of scale in technology, programming, and operations. They can centralize back-office functions, share content across stations, and negotiate more favorable terms with networks, advertisers, and cable/satellite providers.

These economic advantages have made further consolidation almost inevitable in the absence of stricter regulatory limits. As smaller station groups struggle to compete, they often become acquisition targets for larger players like Nexstar and Sinclair.

The pending Nexstar-TEGNA merger represents the continuation of this trend. If approved, it would further concentrate ownership and potentially increase Nexstar’s leverage over networks and distributors.

Impact on Local News and Content

One of the most significant consequences of this consolidation has been its effect on local news. As station groups grow larger, they often implement cost-cutting measures that include:

- Centralized content production: Creating segments at corporate headquarters for distribution across multiple markets

- Shared services agreements: Having one newsroom produce content for multiple stations in the same market

- Staff reductions: Eliminating duplicate positions across newly merged station groups

These practices can reduce the truly local character of news coverage and limit the diversity of perspectives presented to viewers. Critics argue that when dozens or hundreds of stations are controlled by a single corporate entity, the “local” in local news becomes increasingly nominal.

The Regulatory Framework: FCC Oversight

The Federal Communications Commission plays a crucial role in this landscape as the primary regulator of broadcast television. The FCC has the authority to:

- Grant and renew broadcast licenses: Stations must demonstrate they serve the “public interest, convenience, and necessity”

- Enforce ownership limits: Rules restricting how many stations a single entity can control

- Review mergers and acquisitions: Evaluating whether combinations serve the public interest

- Monitor content: Enforcing restrictions on obscenity and indecency

Under Chairman Brendan Carr, the FCC has taken an expansive view of its authority to ensure programming serves the “public interest.” Critics argue this approach risks government interference in content decisions, while supporters contend it properly enforces longstanding standards for broadcast use of public airwaves.

The Kimmel controversy highlighted tensions between the FCC’s regulatory authority and First Amendment concerns about government influence over speech. When Carr suggested there could be “additional work for the FCC” if companies didn’t “take action” regarding Kimmel, it raised questions about the proper boundaries of regulatory influence.

THE BUSINESS OF BROADCAST: FOLLOWING THE MONEY

The Changing Economics of Television

To fully understand the dynamics between networks and station groups, one must follow the money that flows through the television ecosystem.

The traditional broadcast model relied heavily on advertising revenue, with networks and stations sharing commercial inventory. However, several developments have transformed this model:

- Retransmission consent fees: Now a major revenue source for broadcasters

- Digital advertising: Creating new competition for traditional TV ad dollars

- Streaming competition: Eroding viewership for linear television

- Reverse compensation: Stations now paying networks for content

These changes have altered power relationships throughout the industry. Networks like ABC/Disney now operate in a more challenging environment where they must balance traditional broadcast distribution with direct-to-consumer streaming services.

Station groups like Nexstar and Sinclair, meanwhile, have leveraged their control of distribution to extract value from both directions—collecting retransmission fees from cable/satellite providers and using their scale to negotiate favorable terms with networks.

The Affiliate-Network Relationship: A Delicate Balance

The relationship between networks and their affiliated stations represents a delicate balance of mutual dependence. Networks need widespread distribution to attract national advertisers, while stations need compelling programming to attract viewers.

This interdependence typically ensures cooperation, but it can break down during disputes over content, compensation, or strategic direction. The Kimmel controversy revealed how quickly this balance can shift when station groups exercise their preemption rights collectively.

When Nexstar and Sinclair both decided to drop “Jimmy Kimmel Live!”, they demonstrated the leverage that comes from controlling hundreds of local stations. Disney, despite being one of the world’s largest media companies, found itself with little choice but to suspend the show rather than risk a prolonged and potentially damaging standoff with its distribution partners.

Mergers, Acquisitions, and Regulatory Approval

A critical factor in the Kimmel controversy was the pending regulatory approval of Nexstar’s acquisition of TEGNA. This $6.2 billion deal requires FCC approval, giving the commission significant leverage over Nexstar’s business decisions.

Media mergers typically face scrutiny from multiple regulatory bodies, including:

- Federal Communications Commission: Evaluating public interest considerations

- Department of Justice: Reviewing antitrust implications

- Federal Trade Commission: Examining consumer protection concerns

When media companies have significant regulatory matters pending, they may be particularly sensitive to controversy or criticism from government officials. This dynamic can create implicit pressure on content decisions, even without explicit demands.

The timing of Nexstar’s action against Kimmel—coming immediately after FCC Chairman Carr’s critical comments—raised questions about whether regulatory considerations influenced the company’s decision-making process.

THE FUTURE OF BROADCASTING: POWER, REGULATION, AND SPEECH

Evolving Power Dynamics in a Digital Age

As the media landscape continues to evolve, the power dynamics between networks, station groups, regulators, and viewers are likely to shift in sometimes unpredictable ways.

Several trends will shape these dynamics in the coming years:

- Continued consolidation: Further mergers and acquisitions among traditional media companies

- Streaming integration: Networks increasingly prioritizing direct-to-consumer offerings

- Regulatory approaches: Changes in FCC policy based on political leadership

- Technological disruption: Next-generation broadcast standards creating new opportunities and challenges

The tension between centralized control and local autonomy will remain a defining feature of the broadcast landscape. As companies like Nexstar and Sinclair grow larger, questions about their influence over public discourse will likely intensify.

The Regulatory Horizon: Policy Considerations

The regulatory framework governing broadcasting faces increasing pressure from technological and market changes. Key policy questions include:

- Ownership limits: Should the 39% national audience cap be maintained, raised, or eliminated?

- Public interest obligations: How should these be defined and enforced in the digital age?

- Content regulation: What are the appropriate boundaries for FCC oversight of programming?

- Local control: How can policy ensure meaningful local input in an era of national ownership?

These questions transcend partisan politics, though they are often approached differently by Democratic and Republican administrations. The fundamental tension between market efficiency and viewpoint diversity remains regardless of which party controls the regulatory apparatus.

Free Speech Considerations in Broadcasting

The First Amendment has always had a complex relationship with broadcast regulation. Unlike print or internet publishing, broadcasting has historically been subject to greater content restrictions due to its use of public airwaves and its perceived pervasiveness in American homes.

The Kimmel controversy highlighted continuing questions about the proper boundaries between government regulation and broadcast speech. Critics argued that Carr’s comments represented inappropriate government pressure on content decisions, while others contended that broadcasters’ public interest obligations legitimately include consideration of community standards and values.

As media consumption fragments across platforms with different regulatory frameworks, these tensions are likely to become more pronounced. Content that might be restricted on broadcast television flows freely on streaming services and social media, creating regulatory disparities that may become increasingly difficult to justify.

CONCLUSION: THE POWER BEHIND THE SCREEN

The suspension of “Jimmy Kimmel Live!” in September 2025 revealed much more than a controversy over a late-night host’s comments. It illuminated the complex power structures that govern what Americans see on television and the sometimes hidden influence of companies like Nexstar Media Group and Sinclair Broadcast Group.

These media conglomerates, through their ownership of hundreds of local television stations, have acquired extraordinary leverage over both the networks that create content and the regulatory bodies that oversee broadcasting. Their decisions can determine whether millions of Americans have access to particular programs, viewpoints, or information.

As media consolidation continues and the regulatory landscape evolves, the tension between corporate influence, government oversight, and free expression will remain a defining feature of American broadcasting. The Kimmel controversy may be just one episode in this ongoing story, but it provides a revealing window into who truly holds power in America’s media ecosystem.

When you turn on your television tonight, remember that what you see—and what you don’t see—may be determined not just by the networks whose logos appear on your screen, but by the less visible companies that own the stations bringing those networks into your home. In the complex ecosystem of American media, Nexstar and Sinclair have emerged as apex predators, wielding influence that extends far beyond their corporate headquarters to shape the information landscape for millions of Americans.

Written by LimitlessNewsletter, September 2025

ABOUT THE AUTHOR

LimitlessNewsletter provides in-depth analysis of media trends, business developments, and regulatory issues affecting the communications industry. Our team of experienced journalists and industry analysts brings you comprehensive coverage of the forces shaping America’s information ecosystem.

For more information or to subscribe to our regular updates, visit www.limitlessnewsletter.com.

© 2025 LimitlessNewsletter. All rights reserved.

Comments ()